February 6th has quietly become one of the most meaningful dates in my life. Each year, it reminds me of the journey from my first day on a job site to helping families build financial legacies.

My 18th anniversary of leaving the electrical trade in 2008 is more than a milestone; it is a moment to connect the dots between seemingly unrelated careers.

Starting an Electrician Career

I grew up in a small town and graduated from high school in June 1999 alongside just 29 classmates. There wasn’t a big production or grand send-off: only the quiet understanding that life would move quickly after graduation.

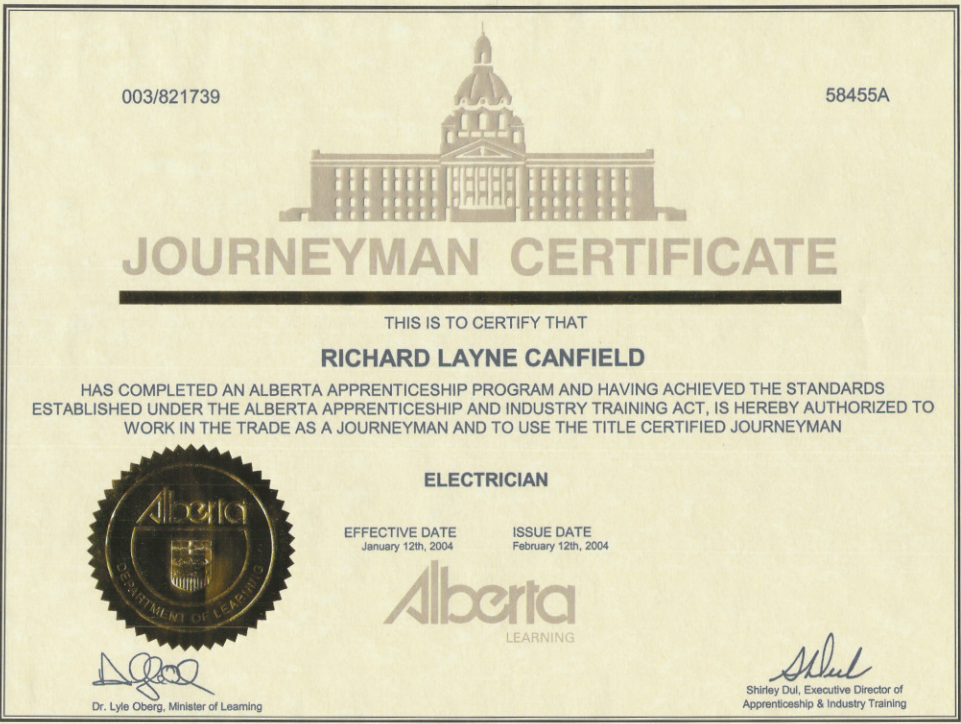

By August 1999, I had purchased $400 worth of hand tools and walked onto my first job site as an electrical apprentice. That decision shaped how I think, work, and teach to this day. I loved the pace, the physical exercise, and the satisfaction of solving real problems with my hands.

Working both independently and as part of a team taught me responsibility and the importance of doing things properly. I also discovered an early passion for teaching others the skills I was learning, a clue to my future calling.

A Shift Toward Industrial Work

In January 2006, a major life change pushed me toward industrial electrical work in the Fort McMurray oil sands. The income potential was higher, especially for those willing to work out of town. Like many Albertans, I worked rotation schedules, typically 14 days in camp followed by 7 days at home, while Edmonton remained home base.

The pace was different, and the common phrase was “hurry up and wait,” which was not my style. Yet the experience taught me valuable lessons about big systems, large projects, and leadership dynamics. I often stepped into leadership roles and learned how large operations functioned.

February 6th, 2008: The End of One Chapter

On February 6th, 2008, I worked my final day as an electrician without realizing that a chapter was closing. Between February and May 2008, I went without income for the first time in my life while I completed a real estate licensing course in Edmonton.

Before leaving the electrical trade, I had capitalized $50,000 to ease the transition, but with hindsight, I realize that capital would have been better positioned inside a properly structured Infinite Banking system, growing for my family instead of being consumed by uncertainty. We can’t change the past, but we can learn from it.

Becoming a REALTOR®

In May 2008, I became a registered REALTOR® and worked primarily with first‑time homebuyers and first‑time investors.

Controlling the financial crisis of 2008 was challenging, yet it provided invaluable lessons about how people behave under financial stress.

I averaged roughly eight to ten transactions per year. More important than volume were the insights about leverage and structure; I saw how financial decisions could help or harm depending on the understanding behind them.

Those lessons became foundational for my future work.

Meeting Jayson Lowe

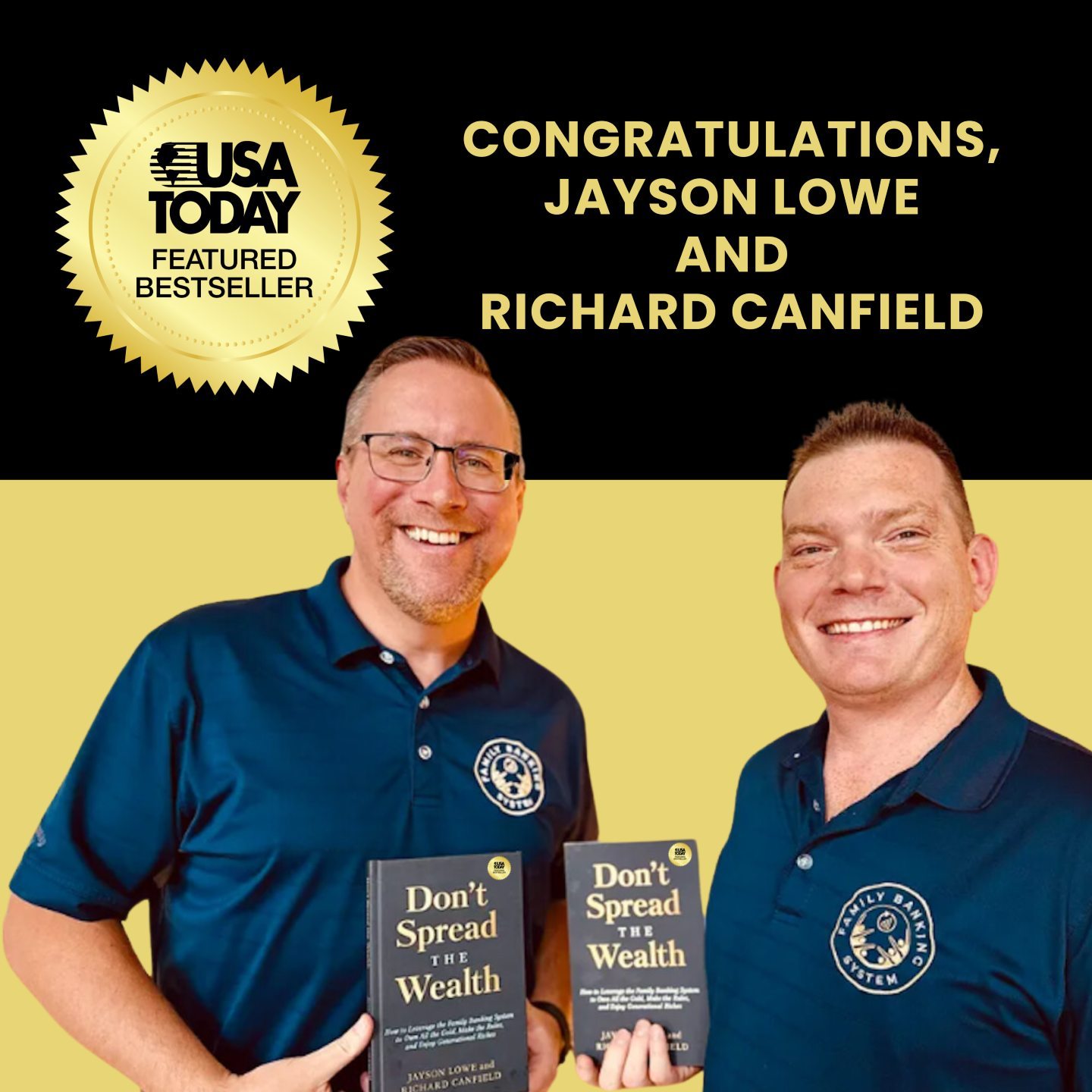

In August 2008, I was introduced to Jayson Lowe of Ascendant Financial. We began working together to help people understand money behavior, debt decisions, and long‑term consequences.

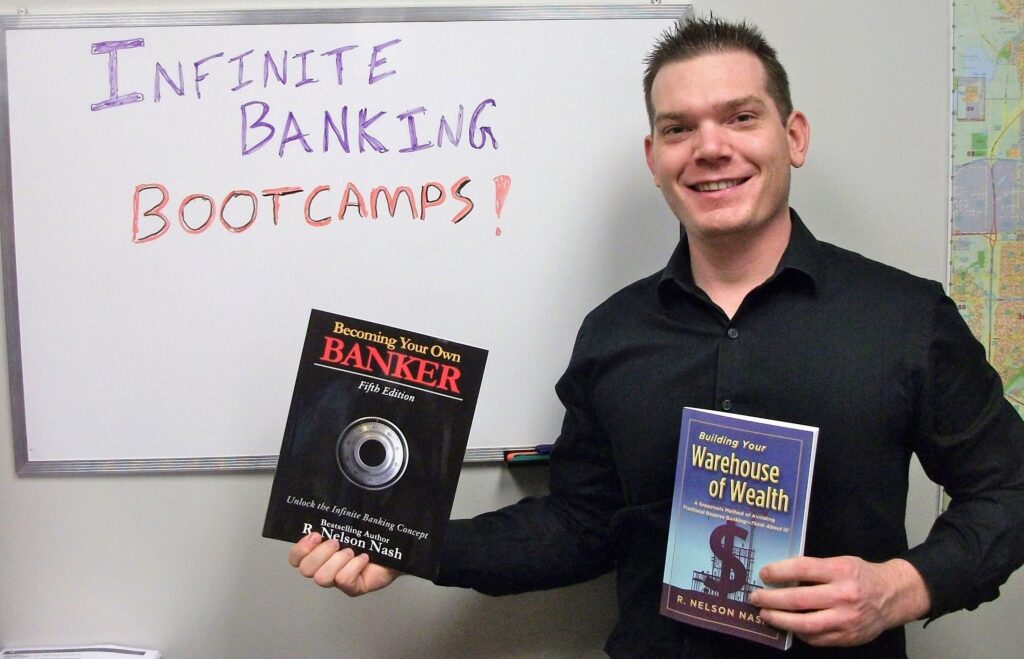

In June 2009, he recommended the book Becoming Your Own Banker by R. Nelson Nash. When I finally read it later that summer, I felt like I had found what I had been searching for my entire adult life.

Control, liquidity, long‑term thinking, and responsibility are the principles at the heart of the Infinite Banking Concept.

Building Something That Didn’t Exist Yet

At the start of 2009, I told myself not to change anything. I didn’t want to scare the housekeeper. I already had my real estate license and no interest in adding another credential.

Eight weeks later, reality set in. If I were serious about helping people implement the Infinite Banking Concept properly, I needed to complete the life insurance qualification program.

By November 2009, I was licensed.

By December 2009, I had committed one evening to another office space and business structure.

Over that Christmas holiday season, I built what I believe was the first formal Infinite Banking Concept presentation ever delivered in Canada. In January 2010, I delivered it to six people.

Funny how often six shows up in this story.

Momentum Builds and Life Changes

By November 2010, I met my incredible wife-to-be, Heather.

In January 2011, we launched the first beta version of the Infinite Banking Bootcamp, a multi-week course designed to teach Canadians how to implement Nelson Nash’s process, understand their financial lives differently, and begin taking control back.

That first cohort had six participants.

Over the following years, we refined and delivered that program month after month, often twice per month, across multiple cities. It was meaningful, energizing, and a ton of work.

We helped thousands of people, but it required relentless effort.

Writing, Mentorship, and Finding My Voice

In January 2016, I became a published author for the first time, thanks to Fong Chua and Jessica Ng through the Peak Potential Success Podcast community.

Their belief in helping people share real ideas led to the book Make More Work Less by Building a Team, where I contributed a chapter on the Infinite Banking Concept and the misconceptions around life insurance.

That experience opened the door to the books, articles, and educational work that followed.

Independence, Then Alignment

Later in 2016, I made the decision to leave the organization I was working closely with and go out on my own to teach the Infinite Banking Concept the way I believed it should be taught.

There were great wins and growing pains.

I realized I needed support on the administrative and backend side of the business so I could focus where I add the most value.

So when Jayson Lowe officially launched Ascendant Financial in 2020, after many conversations and alongside the launch of our podcast, Wealth on Main Street, joining forces made sense.

Today, that work has resulted in more than 2,000 five-star reviews across North America, all inspired by and supporting the legacy of R. Nelson Nash.

Choosing Location Independence and Then Choosing Home

In July 2020, during the COVID lockdowns, our family moved to Chilliwack, British Columbia as a lifestyle choice.

Mountains. Lakes. Space. Memories.

Because our work runs through a computer, an internet connection, and Zoom meetings, we live a largely location‑independent life. I was an early adopter of online meetings long before COVID, so our business wasn’t disrupted the way many others were.

Chilliwack gave us unforgettable experiences.

And then the seasons changed.

We’ve since returned home to Alberta, closer to family and opportunity. When we think about the next 10 years and the options available to our children, there simply isn’t another place in Canada that offers the same opportunity landscape.

Everything Was Training

As I write this on February 6, 2026, it’s been eighteen years since my final day as an electrician.

I don’t see career changes, but preparation.

- The trade taught me systems.

- Real estate taught me leverage.

- Teaching taught me humility.

- Writing taught me clarity.

Nothing was wasted.

What will the next 18 years hold for my family? What will they hold for yours?

Will you experience daily liquidity, long‑term growth, and real control over your family’s financial future?

If not, maybe it’s time to start thinking differently.

If you’d like to go deeper, feel free to explore my books, Don’t Spread the Wealth and Growing Your Own Capital.

The journey continues.