If someone told you that a single book, bought for $50, could give you a better financial education than $45,000 worth of courses and seminars, you might be skeptical.

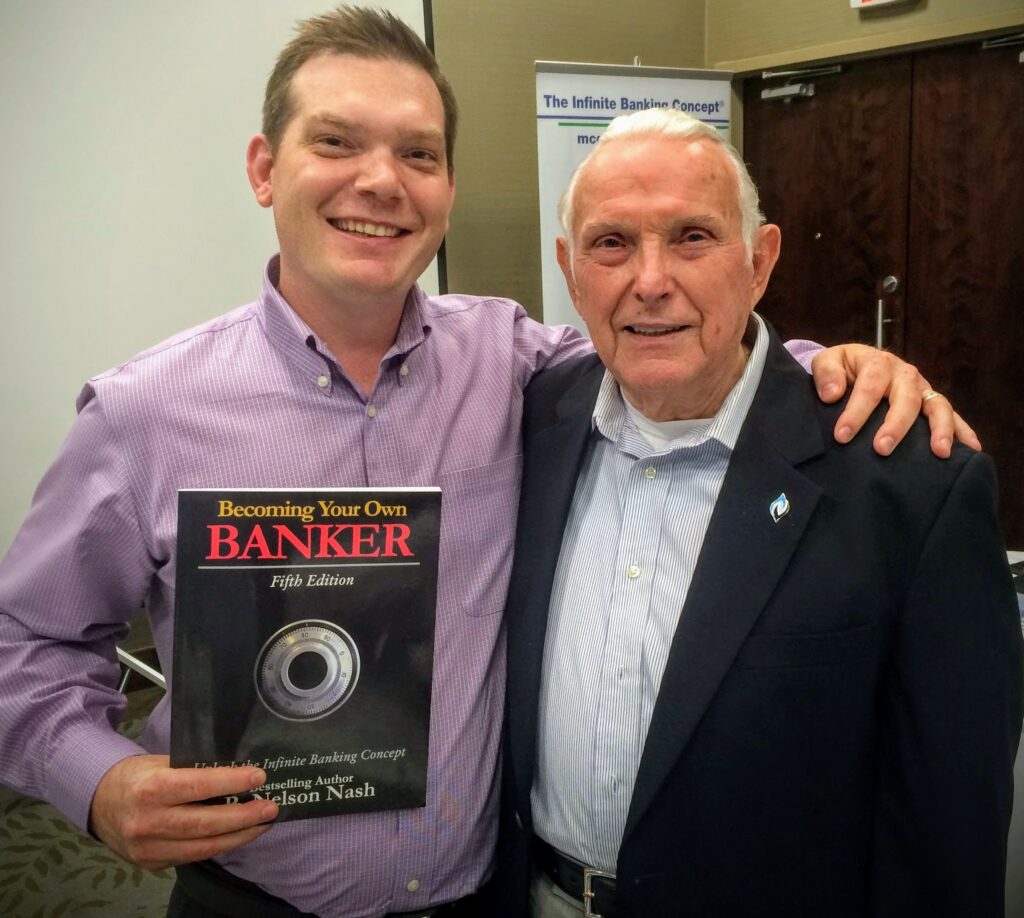

But that’s exactly what happened to me when I discovered Becoming Your Own Banker by Nelson Nash.

Dennis Yu’s insights on marketing and resilience mirror the same principles IBC teaches.

I had the honor of being hosted on the Infinite Banking Initiative podcast, which is produced by the Nelson Nash Institute. During the conversation, I shared my journey with the Infinite Banking Concept (IBC) and the profound impact of Nelson Nash’s book, Becoming Your Own Banker.

Joining me on the podcast were David Stearns, President of Infinite Banking Concepts, and Leigh Barganier, the podcast host, who led a great discussion on how this book changed my financial trajectory.

From Small-Town Hustle to Financial Awakening

I grew up in a small farming community, where hard work was a way of life. My family ran a portable toilet business, and I was introduced to the world of entrepreneurship early on.

By the age of 12, I was a part-owner of a rental property, and by 18, I was already making real estate deals. But like many people, I was following conventional financial wisdom working hard, saving, and trusting traditional investment strategies.

Over the years, I spent tens of thousands of dollars attending financial courses, real estate seminars, and personal development programs.

I thought I was getting a solid financial education. But in 2009, everything changed when a friend and mentor, Jayson Lowe, my co-author on Don’t Spread the Wealth, a USA Today Featured Bestseller, introduced me to Nelson Nash’s book.

The Book That Shook My Understanding of Wealth

I ordered Becoming Your Own Banker for about $50. When it arrived, I had no idea how much impact those pages would have.

As I read through Nelson’s philosophy on the Infinite Banking Concept (IBC), I found myself getting frustrated, actually, angry.

I had just realized that the financial industry had never taught me the most powerful concept of all: the ability to control my own banking system.

The Decision That Changed Everything

After finishing the book, I couldn’t keep this knowledge to myself. I felt an ethical obligation to share it.

But that realization brought its own challenges. I had just started my career as a realtor in Edmonton, Alberta, and switching gears meant getting a life insurance license, something I initially resisted.

Yet, the more I reflected, the more I realized that if I didn’t pursue this path, I’d be living out of integrity.

By late 2009, I got licensed and fully committed to teaching IBC. Looking back, it was one of the best decisions of my life.

Learning from the Master: My Time with Nelson Nash

Meeting Nelson Nash in person was a turning point. I attended my first Nelson Nash Institute Think Tank in 2012 and got to experience his wisdom firsthand.

Nelson was an educator and a visionary who believed in empowering individuals to break free from the traditional banking system.

If you want to see how IBC works in real communities, check out what I learned emceeing the Think Tank.

One of my favorite memories of Nelson was how effortlessly he blended humor into his teaching. He had a way of making complex financial principles simple, often using storytelling to drive home his points.

His famous “Martian story” about equipment financing and self-insurance had the entire room in stitches, but the underlying lesson was profound: we need to rethink how we finance our lives.

Another lesson that stuck with me was Nelson’s insistence on long-term thinking. He encouraged us to make financial decisions that would benefit not just our children, but our grandchildren and beyond.

This philosophy reshaped how I viewed wealth-building.

Infinite Banking in Action: A Client’s Life-Changing Story

Nelson’s teachings have had a significant impact on individuals, families, and businesses.

One notable example is that of a business owner who began implementing IBC in 2014. Shortly afterward, his company faced a financial downturn due to falling oil prices. With banks tightening lending, many businesses struggled, but he was able to turn to the cash value of his policies to keep operations running.

Over time, he used IBC to manage cash flow, cover unexpected expenses, and eventually transition away from dependency on traditional banking. His ability to maintain financial stability during economic uncertainty illustrates the resilience that Nelson’s principles can provide.

Many who have embraced IBC share a similar sentiment: they wish they had learned about it earlier. One client summed up this perspective:

“I was frustrated with traditional investing vehicles when I first met Richard. The private wealth system Richard guided me to create has exceeded every one of my expectations, and when I look to its future all I see is more growth. I wish I knew about this when I was in my 20s. Better yet, I wish my parents knew and opened policies. People need to learn about this and get away from using banks.”

– Hughs Ng

Nelson Nash’s Enduring Legacy

Nelson Nash’s impact extends far beyond those who met him in person. His teachings continue to inspire a growing movement of individuals taking control of their financial future through IBC.

Today, thanks to the Nelson Nash Institute and the efforts of dedicated practitioners, more people are discovering that banking doesn’t belong to the big financial institutions, it belongs to them.

If you’ve never read Becoming Your Own Banker, do yourself a favor and get a copy.

And if you have read it, read it again. I still reference my own well-worn copy regularly, using it as a guide for both my clients and myself.

Nelson used to say, “The infinite banking concept is about how you think.” That shift in thinking transformed my life, and it can transform yours, too.

Thank you, Nelson. Your wisdom continues to change lives, and I’m honored to be a part of carrying your message forward.

Want to discover how to take control of your financial future? Check out “Becoming Your Own Banker“.