Running a business is a constant balancing act—each challenge either holds you back or helps you grow, much like managing your finances.

In my conversation with Dennis Yu, a digital marketing expert who’s worked with top brands like Nike, we explore the common mistakes entrepreneurs make and how to avoid them.

Dennis’ approach to entrepreneurship aligns with the same principles I teach: take control of your life and finances, unlock your potential, and drive growth that’s sustainable for the long term.

By applying simple but powerful marketing and financial management strategies, you can survive and thrive in your business.

Don’t Let Fear Hold You Back: Embrace It and Grow

The entrepreneurial journey is rarely a straight path, and Dennis reflects on one of the defining moments of his career.

He recalls being invited to speak live on CNN about the Cambridge Analytica scandal—a pivotal moment for Facebook and the digital marketing industry. “It was surreal,” he says, describing the pressure of knowing millions of people, including industry leaders like Mark Zuckerberg, might be watching.

Dennis Yu on CNN

Despite his nerves, he realized the key wasn’t in presenting himself as an expert but in serving the audience. “That shift in perspective changed everything for me,” he says.

Rather than focusing on the fear of making a mistake, Dennis reframed the situation. “I told myself, ‘You’re here to make sense of something complicated for people who are confused.’ It wasn’t about me—it was about them,” he explains. Once he embraced that mindset, the words flowed naturally.

As Leila Entezam teaches, emotional discipline is the real power move.

He emphasizes how this lesson extends beyond live TV.

This lesson isn’t just valuable for public speaking. Whether you’re pitching to a client, running a team meeting, or managing business finances, the real power comes from focusing on what your audience or clients need rather than obsessing over your own fears.

Dennis’ shift in perspective resonates with me because, much like fear, financial uncertainty can hold entrepreneurs back. But instead of avoiding it, we need to embrace the challenge. Entrepreneurs who successfully manage their finances—like those who adopt the Becoming Your Own Banker process—take control of their financial future, turning fear into fuel for growth.

Entrepreneurs who successfully manage their finances—like those who adopt the Becoming Your Own Banker process—take control of their financial future, turning fear into fuel for growth.

Just like Andreas Pettersson discovered, fear can either paralyze or fuel transformation.

How Setbacks Can Fuel Business Growth

Dennis explains that the Cambridge Analytica event quickly made him a recognizable figure in the media. “It wasn’t about being an expert; it was about being the familiar face reporters knew to call,” he says.

This visibility led to speaking engagements and an influx of business leads. But instead of handling everything himself, Dennis began connecting clients with trusted partners, gaining stakes in these agencies.

Then COVID-19 hit, and all his speaking engagements were canceled. Forced to adapt, Dennis shifted to virtual meetings and embraced Zoom. “I’m a math guy, not a media person,” he admits, “but I bought equipment and taught myself how to run virtual meetings.”

What seemed like a setback turned into an opportunity to reinvent how he did business. Zoom calls became an efficient way to connect with anyone in the world.

That’s the same way I connected with Dennis via Zoom to host this great session.

Richard Canfield and Dennis Yu on Zoom meeting

This insight hits home because it directly applies to how we manage our finances. Setbacks in business aren’t the end—they’re opportunities to adapt and grow. Similarly, in times of economic uncertainty, having a flexible financial strategy, like Infinite Banking, gives entrepreneurs the ability to pivot when needed. By ensuring that your cash flow is under your control, you’re prepared for any challenge.

I agree with Dennis—those short Zoom calls can lead to meaningful collaborations today. Instead of the traditional business card exchange, networking now is about providing value and helping others. When you do that, you build connections that can lead to new opportunities.

By sharing the expertise of respected figures in your industry, you create valuable content that strengthens your authority.

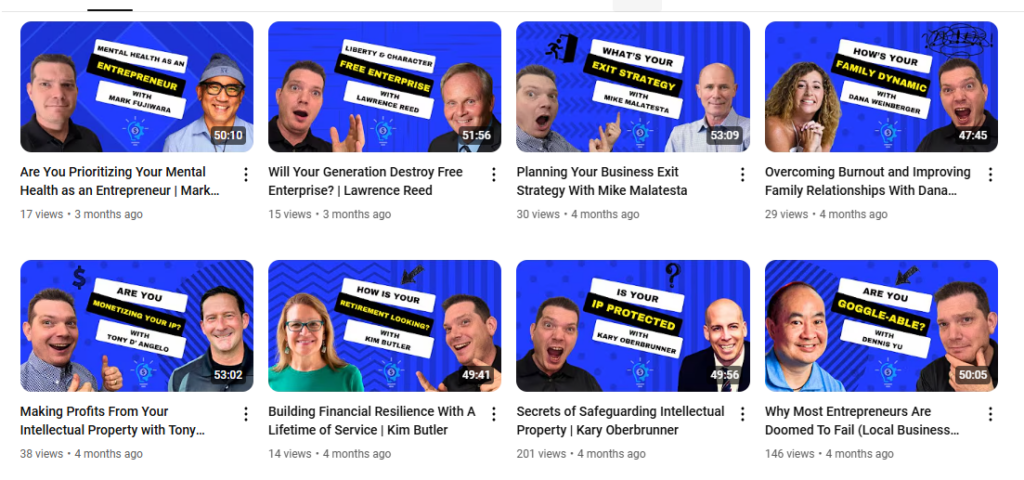

For example, over the last few months, I have been sharing my experience with tons of people and making an inventory of it on my channel.

Richard has been sharing the experience with other experts via Zoom

Health Comes First: You Can’t Build a Business Without It

The health challenge Dennis faced nearly cost him his life, though he brushes over it with humility. He recalls a conversation with Dr. Ovadia, a heart surgeon, who shared the story of an entrepreneur in his mid-forties. The man was busy, overworked, and didn’t prioritize his health, believing a heart attack wouldn’t happen to him. Despite the doctor’s skill, the patient passed away.

Dennis Yu and Dr. Ovadia are discussing health

Dennis didn’t have a heart attack, but he did collapse from another health issue, a wake-up call that highlighted the importance of taking care of his body before it’s too late.

“You don’t know when a heart attack will hit,” Dennis reflects, emphasizing that many people feel fine until it’s too late.

Dennis has spent hundreds of thousands of dollars researching health treatments and supplements, seeking to prevent the kind of burnout that affects so many in his industry. “When it happens, it clears your schedule—but it’s too late to fix it,” he warns.

Dennis believes that true success starts with health—everything else falls apart without it.

Mental health isn’t optional if you want long-term success, as Mark Fujiwara made clear during our conversation.

This lesson is particularly relevant when thinking about financial health. Just as physical health is a foundation for success, financial health is key to thriving as an entrepreneur.

If you’re not actively managing your money, it can lead to disaster. But when you take control—through something like the Becoming Your Own Banker process—you can create long-term wealth that provides stability for both your personal life and your business.

The Value of Young Adults in Growing Your Business

Dennis Yu’s goal is to empower the next generation of marketers and create jobs in local communities through effective marketing. His approach focuses on measurement—providing entrepreneurs with tools to track their digital performance.

He believes that small businesses can thrive by understanding the tools available and hiring young people from their communities to manage their marketing efforts.

One example is Mia, a young lady who transformed her father’s struggling restoration business. After completing Dennis’s program, Mia not only helped her dad but also started her own agency. Her business grew, and she hired other young adults with little experience, giving them the skills to manage digital marketing.

Dennis’s model isn’t just about marketing—it’s about teaching young adults to create value and build careers. Instead of pushing young people toward traditional college routes, Dennis provides mentorship, hands-on experience, and practical skills.

At a National Funeral Directors Association (NFDA) conference, Dennis invited the children of funeral directors on stage to show how they used technology and marketing to grow their family businesses. This hands-on approach helped young people who had no interest in their family’s business take an active role in its success.

Dennis’s approach focuses on mentorship and apprenticeships, aiming to create a ripple effect. By teaching one young person, he’s helping them create jobs for others in their community. His ultimate goal is to create a million jobs through marketing skills.

Use AI to Improve, Not Replace You

As technology continues to grow, many entrepreneurs fear that tools like AI will replace their jobs. But Dennis doesn’t see it that way. “AI isn’t here to take your job—it’s here to help you do your job better,” he says.

He explains that AI is a tool, just like any other piece of technology. “AI can help you come up with ideas, organize content, and even personalize messages. But it’s not going to replace the human connection you need to build your business.”

Dennis’s point is clear: AI should be used to improve what you’re already doing, not replace it. It’s a tool to make your work easier, not a replacement for the unique value you bring to your business.

This insight is especially relevant when we think about how to use tools like the Infinite Banking Concept® in our financial lives. AI and other technologies can improve the way we manage our finances, just like they can improve how we run our businesses.

Using technology can help us streamline operations and become more efficient in building wealth, but it’s important to remember that these tools serve us—they don’t replace the core principles we rely on. When it comes to finances, using the right tools can empower you to achieve financial independence, but the human touch remains essential for success.

Key Takeaways

- Fear is a sign you care: Use fear to fuel your desire to help others and take control of your financial future.

- Setbacks are chances to grow: Adapt to change, and create financial systems that give you control over your wealth.

- Health comes first: Without health—physical or financial—your business can’t grow. Invest in both.

- Build relationships, not just sales: Trust is the foundation of success, both in business and in financial decisions.

- Use technology to improve your efforts: Technology can optimize your wealth-building strategy, but it can never replace the need for control and personal involvement.

Want to unlock your entrepreneurial potential?

Get my free guide on “Maximizing Success By Understanding How You Function.”